List Of Documents Required For Home Loan When Buying Resale Flat

Table of Content

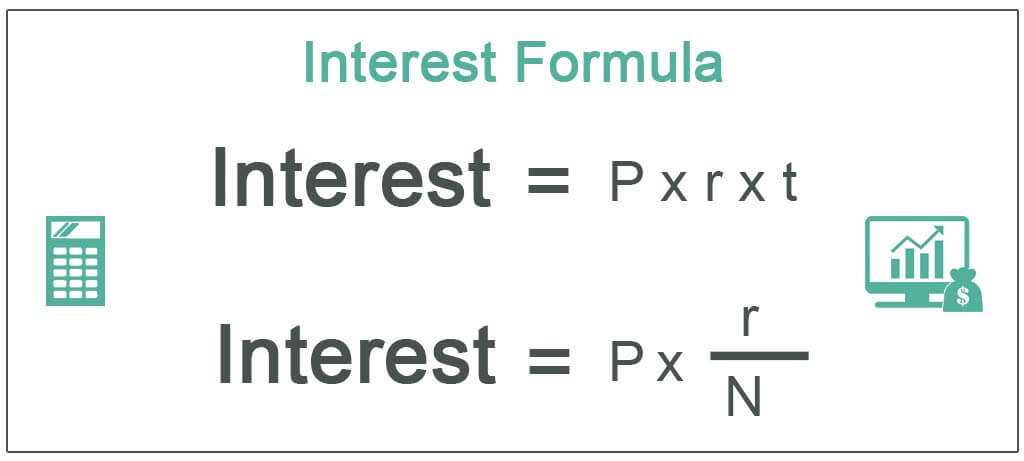

A seller can’t legally sell a property without providing NOCs to the buyer. Hence, if the seller is not able to provide you NOCs for the flat, it will be wise not to buy it. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal. In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. The EMIs will proportionately increase with every partial disbursement made as per the progress of construction.

This means that it retains the legal right to the property in the event of non-payment. For those buying an HDB resale flat this year, you should essentially know how much you should be paying. You can do this by checking out the pricing trends across different areas in Singapore.

How does a home loan work in India?

While we believe that the information provided to you is correct on the basis of the data provided to us, please consider this data and information as indicative and use your judgement and verify any information before making any decision. Up to 1.50% of the loan amount or ₹4,500 whichever is higher, plus applicable taxes. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower. Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

You can take disbursement of your home loan once the property has been technically appraised, all legal documentation has been completed, and you have made your down payment. With this option you get a longer repayment tenure of up to 30 years. Working Capital, Debt Consolidation, Repayment of Business Loan, Expansion of business, Acquisition of Business asset or any similar end usage of funds. The maximum period of repayment of a loan shall be up to 30 years for the Telescopic Repayment Option under the Adjustable Rate Home Loan.

Other Conditions

Other than this, you will also have to submit a letter from the society which contains details such as the year of construction of the building, the number of floors and elevators in the building, the built-up area of the apartment, etc. Is it important to check the tax paid receipts while buying a resale flat? Yes, it is very important to check all the latest tax paid receipts while you are purchasing a resale property. This will enable you to know whether the property has any outstanding dues or not.

ABCL and ABC Companies are engaged in a broad spectrum of activities in the financial services sectors. Any recommendation or reference of schemes of ABSLMF if any made or referred on the Website, the same is based on the standard evaluation and selection process, which would apply uniformly for all mutual fund schemes. You are free to choose the execution facilities in the manner deemed fit and proper and no commission will be paid by ABSLMF to ABML / ABFL if you choose to execute a transaction with ABSLMF on the Website, unless otherwise agreed by you and ABML/ABFL separately. Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website. This Website is provided to you on an "as is" and "where-is" basis, without any warranty.

Home Loan Recommended Articles

A resale house may include room layouts, ceiling heights, and lighting that may have made sense in the 1950s or earlier — formal dining rooms, small kitchens, fewer bathrooms and windows, and the like. Possibly the biggest draw for many new construction buyers is the chance to have a house where everything is new-new-new and just as the buyer wants it to be, rather than compromising and accepting a previous owner’s tastes plus a certain amount of wear and tear. You can retrofit many elements of an existing house to improve its energy efficiency, but it’s costly.

It is important to ensure that the seller produces all the relevant original documents. Newly built homes come with modern fire retardants in materials, such as carpeting and insulation, unlike most existing houses. Builders also hard-wire smoke and carbon monoxide detectors into their homes, making it unnecessary for new owners to install less-dependable battery-powered detectors. Many builders also back up their hard-wired detectors with battery power to handle electrical outages.

The users should exercise due caution and/or seek independent advicebefore they make any decision or take any action on the basis of such information or other contents. PropTiger.com shall not be liable in any manner for any losses, injury or damage suffered by such person as a result of anyone applying the information in these articles or making any investment decision on the basis of such information , or otherwise. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. Also required is an assessment bill to the society from the local civic body, a copy of the property card and a receipt for the payment of the registration fee. All the documents that are required in the primary sale of property are also required in the resale of the property.

Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed. Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on .

You can also get your home-loan pre-approved from the bank where you already have an account. This will reduce your hassle and your loan will get sanctioned within a few hours of placing the request. All these documents form a crucial part of the chain of documents that you need at the time of buying a resale flat. You are also required to submit these to the bank while applying for a resale home loan. AXIS Bank is another major home loan provider which caters to the specific needs of those who wish to purchase a resale flat. The home loan scheme offered by Axis Bank is called “Asha Home Loans”.

As mentioned above, the secondary market segment is also quite important for banks and hence, almost all leading banks in the country, including SBI, HDFC, ICICI Bank, Axis Bank, etc., offer homes loans for the purchase of resale properties. Also, there is no difference in the interest rates on loans for old properties, whatsoever. For the uninitiated, a resale flat is a ready-to-move-in property that one would buy from an individual seller. Resale basically means that the current owner was alloted this property by the builder of the project or another seller.

The buyer should seek clear ownership history if the property has changed hands multiple times. Apart from the sale deed, other papers that are needed in the sub-registrar's office are a letter from the society giving details about the number of floors in the building, the construction year, the apartment's built-up area and the number of elevators, etc. Builders often have mortgage subsidiaries or affiliates, and are able to custom-tailor financing — down payments, “points,” other loan fees and even interest rates — to your specific situation. Many are also willing to work with you to help defray closing costs at settlement. There are a number of reasons you might prefer a resale house, even if it needs work. For instance, you may have your heart set on moving to a specific neighborhood in the city or a close-in suburb, where newly constructed houses are rare or not available unless you buy an existing home, tear it down, and build a new home on the same lot.

If you use this Website from outside the India, you are entirely responsible for compliance with all applicable local laws. There is no warranty or representation that a user in one region may obtain the facilities of this website in another region. This is the amount of money you will be borrowing from the bank or financial institution. There are different kinds of home loans options that are made to suit each unique situation.

Balance Transfer Loan

The interest rate for the HDB loan is pegged to the current CPF OA interest rate + 0.1%. Hence, as the current CPF interest rate is 2.5%, it makes the effective rate for a HDB loan 2.6%. This interest rate has also largely remained stable vis a vis the more variable interest rates from the bank. Bank interest rates have largely hovered in the 1% – 1.3% range last year. Depending on the market conditions, bank loan rates are usually more variable.

Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive. You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. While the price hike affects both mature and non-mature estates, those located in mature estates are more expensive. They will also have a higher resale price since these flats offer more accessibility as they are located near the city centre, MRT stations, shopping malls, or schools. The No Objection Certificate certifies that the society has no objection to transfer the share certificate in favor of prospective property buyers.

Comments

Post a Comment